Crash Course Module 1

You'll Learn:

1) A Detailed Explanation of Exactly How the Tax Lien Investment Process Works so You Can Get Started Right.

2) The Specific Strategies we use to Acquire Valuable Real Estate for as Little as 25% of the Value of the Property (public recorded documentation provided).

3) Where and how to find Tax Sale Properties and Acquire them from the Comfort of Your Home.

4) Our #1 “Get the Property Every Time” Strategy for Beginner’s to Start Building Cashflow.

5) The Only 3 Ways You Can Acquire Tax Lien Certificates.

6) How to Safely Earn Fixed Secured Returns up to 16%, 18%, and even as High as 25% Interest per Year from the Comfort of Your Home.

7) Actual Case Studies that Show Profitability and Timeframe to Make Profit (public record documentation provided).

You'll Learn:

1) Case Study – Property acquired for $2,800 total purchase price worth over $140,000.00. The strategy used and the net profit. Public record documentation provided.

2) The Most Important Lesson You Must Know First Before You Begin Investing in Tax Lien Certificates and Tax Deed Properties.

3) The Only Strategy Available to Acquire Houses for as Little as $500 Total Purchase Price (public record documentation provided).

4) The #1 Mistake Beginner’s Make and Exactly How to Avoid It.

5) Where and How to Acquire Lists of Tax Lien Certificates & Tax Deed Properties.

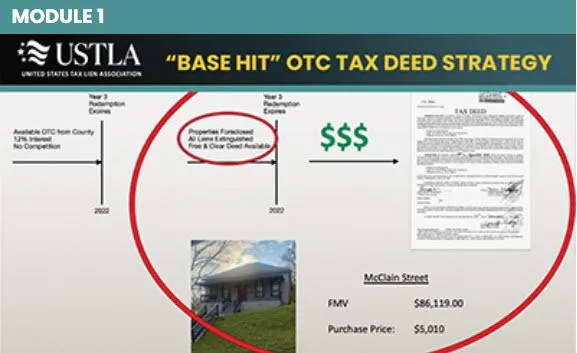

6) Actual Case Studies that Illustrate the Profitability of USTLA’s “Base-Hit Strategy,” which is our #1 strategy to help beginner’s acquire their first property.

7) The Important Differences Between Tax Lien Certificate States and Tax Deed Property States, and which is Best for You.

You'll Learn:

How to safely use your retirement funds to invest in Tax Lien Certificates and Tax Deed Properties.

Case Study – Property Acquired for Only $3,634 Total Purchase Price worth over $70,000.00. The strategy used and the net profitability.

Our Top 7 Strategies you can use to make a profit on one property.

Revealing Reports that show over 650 lists of Tax Lien Certificates and Tax Deed Properties currently available that can be acquired from the comfort of your home without traveling.

How to Get Started with Limited Capital & Limited Time.

Step #1: Exactly how our successful clients got started.

Exactly what we do here at USTLA, and how we can help you achieve your financial goals through the power of investing in Tax Lien Certificates & Tax Deed Properties.

Join the Conversation

Domestic Support

International Support

As with all investments, there is always an element of risk. Even if the interest rates are written into state government law, mandated by state government law, and are regulated by state government law, there is a chance of you losing part or all of your investment. You must always try to get the best education and practice safe investing, no matter which investment vehicle you choose.